Közép- és Kelet-Európában (KKE) 2022-ben megnőtt a vállalati fizetésképtelenségek száma az energia és a nyersanyagok magas ára, a gyors kamatemelések sorozata, az elmúlt évtizedek legmagasabb inflációja és az ukrajnai háborúval kapcsolatos bizonytalanság miatt.

Növekvő aggodalmak

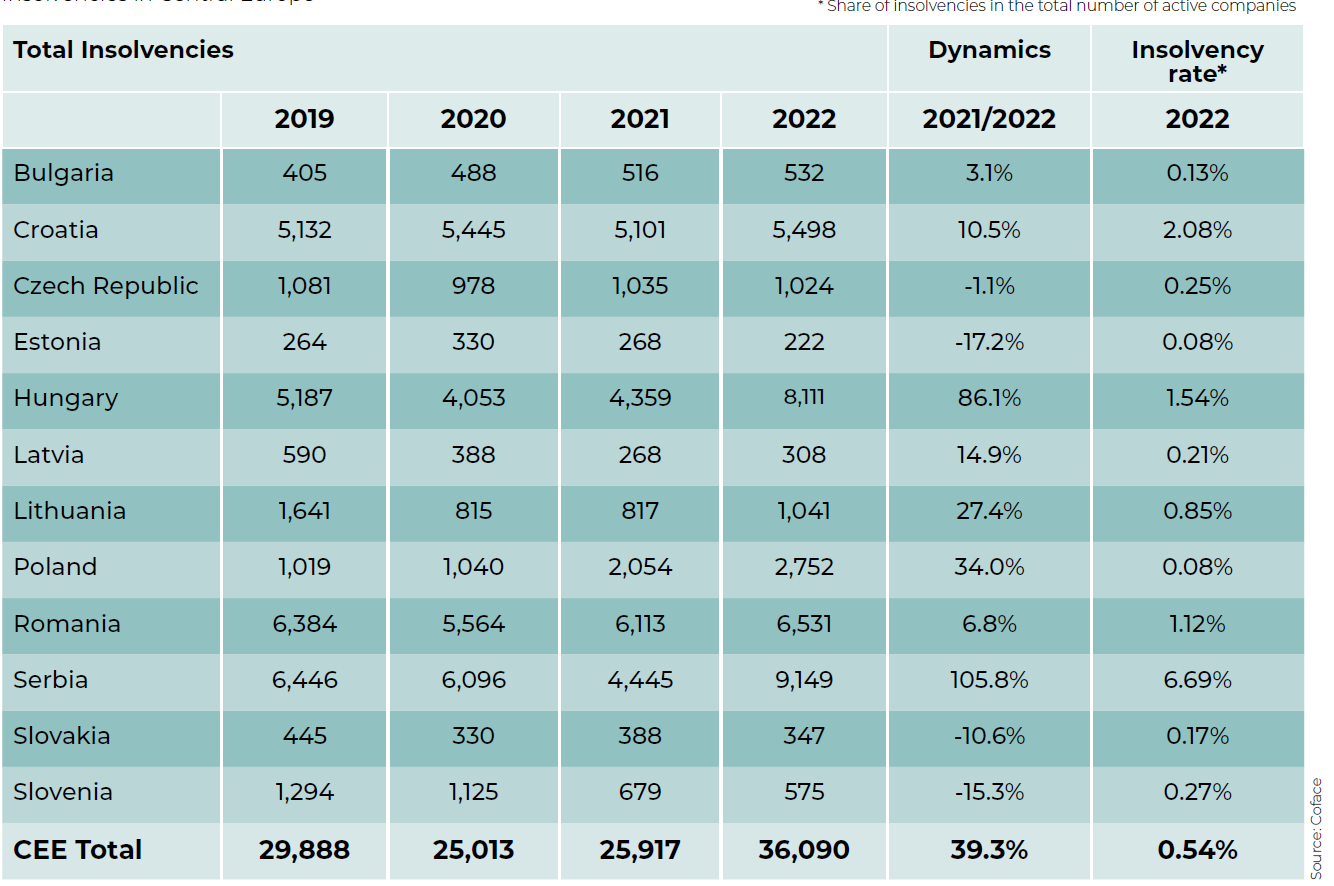

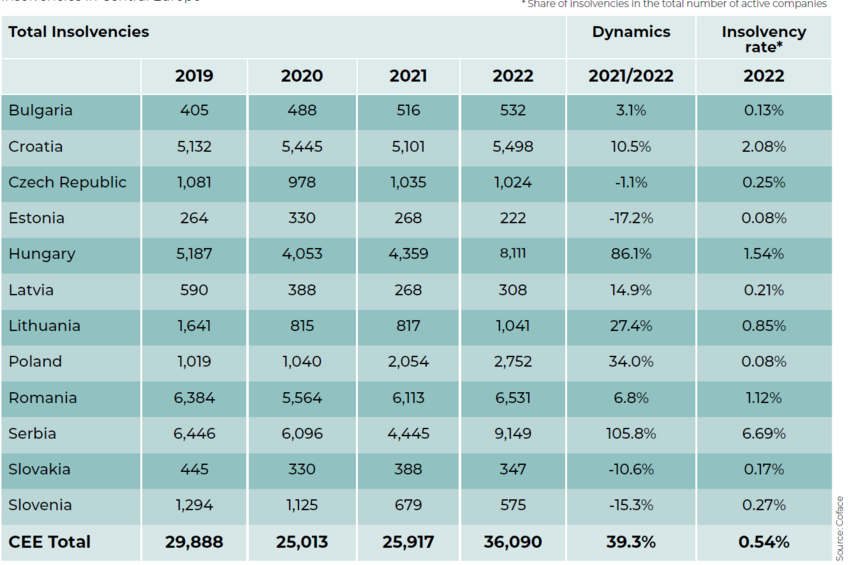

- Nyolc országban nőtt a fizetésképtelenségek száma (Bulgária, Horvátország, Magyarország, Lettország, Litvánia, Lengyelország, Románia és Szerbia), négy országban pedig csökkent (Csehország, Észtország, Szlovákia és Szlovénia).

- A fizetésképtelenségek 2020-as csökkenése után 2021-ben már nőtt az eljárások száma, 2022-ben pedig felgyorsult az emelkedés.

A közép- és kelet-európai (KKE) régió az elmúlt három évben jelentős gazdasági változásokon ment keresztül. A nagyfokú heterogenitás, a különböző támogatási intézkedések és a jogszabályi változások jelentősen befolyásolták a fizetésképtelenségi trendeket. A Covid-19 világjárvány és az azt követő gazdasági visszaesés, valamint az ukrajnai háború gazdasági hatása nemcsak a makrogazdasági tevékenységre és az árupiacokra, hanem a vállalatok likviditására is negatívan hatott.

A közép- és kelet-európai gazdaságok 2021-ben és 2022 első felében a fellendülés jeleit mutatták, a legtöbb országban a jelentős volatilitás ellenére magasabb növekedési rátákat regisztráltak. "A 2022-es év többnyire szilárd gazdasági aktivitást hozott, Horvátország és Szlovénia GDP-növekedése meghaladta az 5%-ot, Lengyelország, Románia és Magyarország növekedési rátája pedig megközelítette azt" - mondta Grzegorz Sielewicz, a Coface közép- és kelet-európai régiójának vezető gazdasági elemzője."Ezzel szemben Észtország 1,3%-os csökkenéssel recesszióba esett."

A kormányok által 2020-ban bevezetett támogatási intézkedések hozzájárultak a vállalkozások fizetésképtelenségének csökkenéséhez. Ezen intézkedések megszüntetésének folyamata fokozatosan zajlott, a vállalatok 2021-ben még mindig részesülnek belőlük az alacsony kamatlábak mellett.

"2022-ben azonban a fizetésképtelenségek egyértelmű növekedését tapasztaltuk, mivel a vállalatoknak számos kihívással kellett szembenézniük, többek között a magas energiaárakkal, a nyersanyagárakkal, a gyors kamatemelések sorozatával, az elmúlt évtizedek legmagasabb inflációjával és az ukrajnai háborúval kapcsolatos bizonytalansággal."

- Grzegorz Sielewicz.

A Coface becslése szerint a közép- és kelet-európai országokban a 2021-es 25 917-ről 2022-re 36 090-re emelkedett a vállalati fizetésképtelenségi eljárások száma, ami 39,3%-os növekedést jelent. Nyolc országban (Bulgária, Horvátország, Magyarország, Lettország, Litvánia, Lengyelország, Románia és Szerbia) több fizetésképtelenségi eljárás indult 2022-ben, mint egy évvel korábban, négy országban pedig csökkenés volt tapasztalható (Csehország, Észtország, Szlovákia és Szlovénia). A fizetésképtelenségek számának nagymértékű megugrását Szerbiában és Magyarországon regisztrálták (106%, illetve 86%), míg a legnagyobb mértékben Észtországban csökkentek az eljárások (17%-kal).

A fizetésképtelenség minden szektorban nőtt, nem csak az energiaigényes ágazatokban

Nem meglepő módon az energiaigényes ágazatok szenvedték meg leginkább a nyersanyagárak emelkedését, és ezáltal a magasabb működési költségeket. Lengyelországban például a vegyipar, a fémipar, a papír- és faipar, valamint az agrár-élelmiszeripar az átlagosnál hosszabb fizetési késedelmekről számolt be, és többségüknél az előző évhez képest is hosszabb késedelmeket tapasztaltak. Ezek az ágazatok a regionális fizetésképtelenségi statisztikákban is széles körben képviseltették magukat: a fém-, a papír-, a fa- és az agrár-élelmiszeripari ágazatban magas és egyre gyorsuló fizetésképtelenségi arányt tapasztaltak.

Az építőipari ágazatot is jelentősen érintette a helyzet. A fizetésképtelenségi ráták különösen magasak Horvátországban, Észtországban, Magyarországon, Lettországban, Litvániában és Lengyelországban, az építőanyagok és az inputanyagok magas ára miatt. Ebben az ágazatban a kamatemelések és a szárnyaló infláció miatt a lakáspiac is lassult, miközben a munkaerőhiány is akadályt jelentett.

Végül a kiskereskedelem egy másik olyan ágazat, amelyben a legtöbb országban jelentős a fizetésképtelenségek száma, bár a fizetésképtelenségi ráták és az eljárások növekedése 2022-ben viszonylag korlátozott maradt. A tartós infláció egyre nagyobb terhet ró a fogyasztói kiadásokra, ami a fizetésképtelenségek számának növekedéséhez vezethet ebben az ágazatban.

"A gazdasági kilátások enyhén szólva is bizonytalanok maradnak. Szakértőink az elkövetkező hónapokra az infláció lassulását prognosztizálják, de ennek ellenére a közép- és kelet-európai régió gazdaságainak nagy része 2023-ban gyengébb növekedéssel számolhat. Az infláció ugyanis jóval a központi banki célok felett marad. Ezáltal továbbra is emelni fogják a kamatokat, és ez negatív hatással lesz a vállalatok fizetőképességére. Ezért úgy véljük, hogy a fizetésképtelenné vált vállalatok száma 2023-ban tovább fog nőni"- teszi hozzá Jarosław Jaworski, a Coface közép- és kelet-európai régiójának vezérigazgatója.